Understanding World Systems Theory is critical for emerging markets investors.

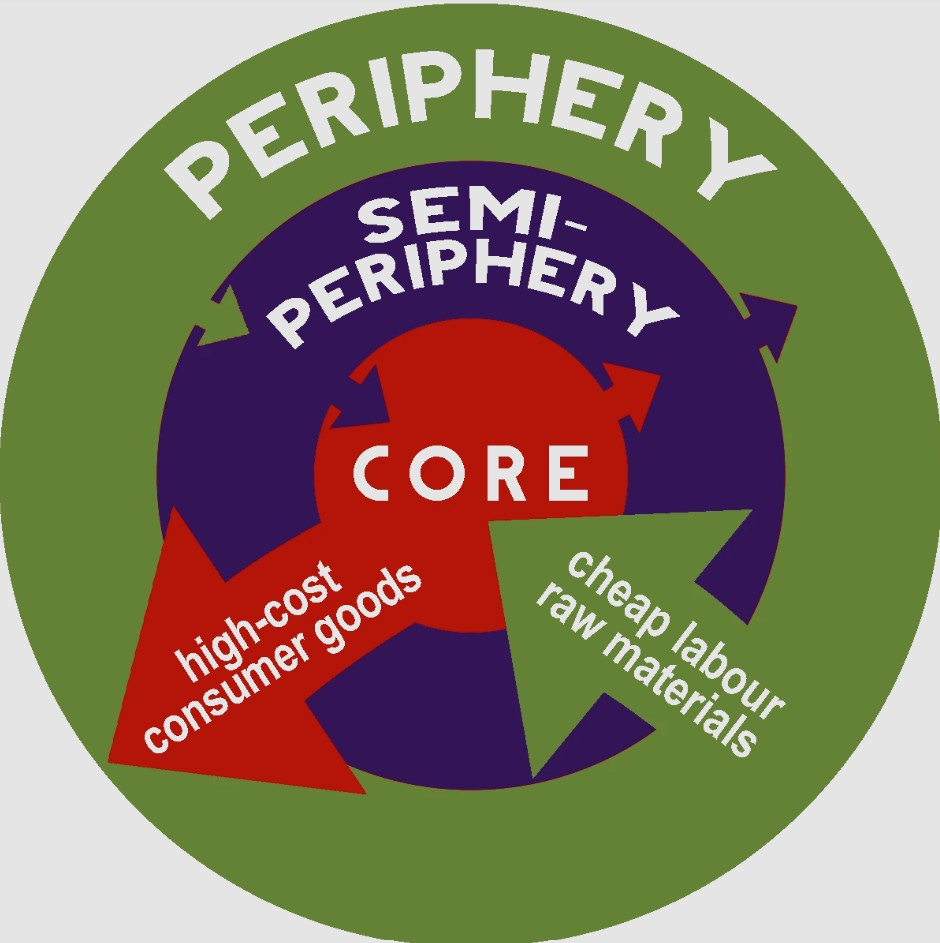

World-Systems Theory identifies the world economy as a system where powerful "core" nations such as the U.S., Western Europe, and Japan, focus their economies on extracting raw resources from “peripheral” nations, before processing and selling higher-value manufactured products back to the periphery at a premium.

World Systems Theory can be seen in the cocoa trade. While the Ivory Coast produces 45% of the world’s cocoa, it receives only about 7% of the global revenue from the commodity. While nations like Germany control upwards of 25% of the $100bn+ industry by manufacturing the beans into products like chocolate and cocoa powder that are significantly higher value exports.

Nations in the global south are taking action and challenging this unequal system.

Take Indonesia for example. The country banned raw nickel exports in 2020, requiring nickel to be first be processed domestically.

Indonesia now controls 40% of global nickel processing capacity, has attracted over $15 billion in electric vehicle battery investments, and has seen its processed nickel exports surge from $1.1 billion in 2014 to nearly $30 billion in 2023.

Namibia and Zimbabwe have followed suit, imposing bans on exports of certain unprocessed mineral ore to encourage higher value-added domestic processing.

This dramatic shift demonstrates how peripheral nations can leverage resource advantages to force their way up the value chain, challenging the traditional core-periphery relationship that has historically kept developing nations locked in resource extraction roles.

Understanding World-Systems Theory provides a framework for identifying structural shifts in the global economy before they become obvious in traditional market analysis.

As more peripheral nations upgrade their position in global value chains, investors who can identify and capitalize on these structural changes will find themselves well-positioned to capture the significant value creation that accompanies such transformations.